Can you use super algorithm to predict the business cycles, and make a better return on your money? Some people says its possible to do it with a regular PC or Mac and some software.

High-frequency trading (HFT) is a type of algorithmic trading, specifically the use of sophisticated technological tools and computer algorithms to rapidly trade securities.

HFT uses proprietary trading strategies carried out by computers to move in and out of positions in seconds or fractions of a second. Firms focused on HFT rely on advanced computer systems, the processing speed of their trades and their access to the market.

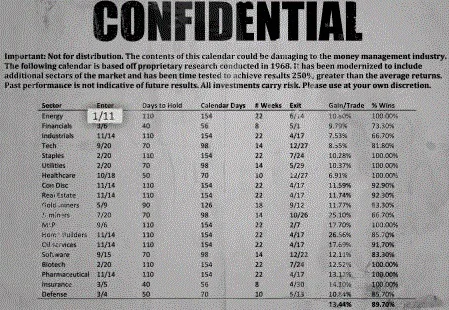

Wall streets secret agenda or list or periodic dates...

The term business cycle refers to economy-wide fluctuations in production, trade and economic activity in general over several months or years in an economy organized on free-enterprise principles.

The business cycle is the upward and downward movements of levels of gross domestic product and refers to the period of expansions and contractions in the level of business fluctuations around its long-term growth trend.

These fluctuations occur around a growth trend, and typically involve shifts over time between periods of relatively rapid economic growth and periods of relative stagnation or decline. Algorithm crunching this statistics is the new "cycle analysis" approach and ways to use HFT in the trading world.

Then the question is can we ordinary people, have access to this kind of information and can we just stand in front of our computer to see it loosing money we don't have? Then later, making the money, hopefully.

Are we capable of not intervening, and letting the machine taking the decisions?